Some Of Property By Helander Llc

Some Of Property By Helander Llc

Blog Article

Property By Helander Llc Can Be Fun For Everyone

Table of ContentsProperty By Helander Llc for DummiesThe Main Principles Of Property By Helander Llc Property By Helander Llc Can Be Fun For AnyoneFacts About Property By Helander Llc RevealedSome Ideas on Property By Helander Llc You Need To KnowAll About Property By Helander Llc

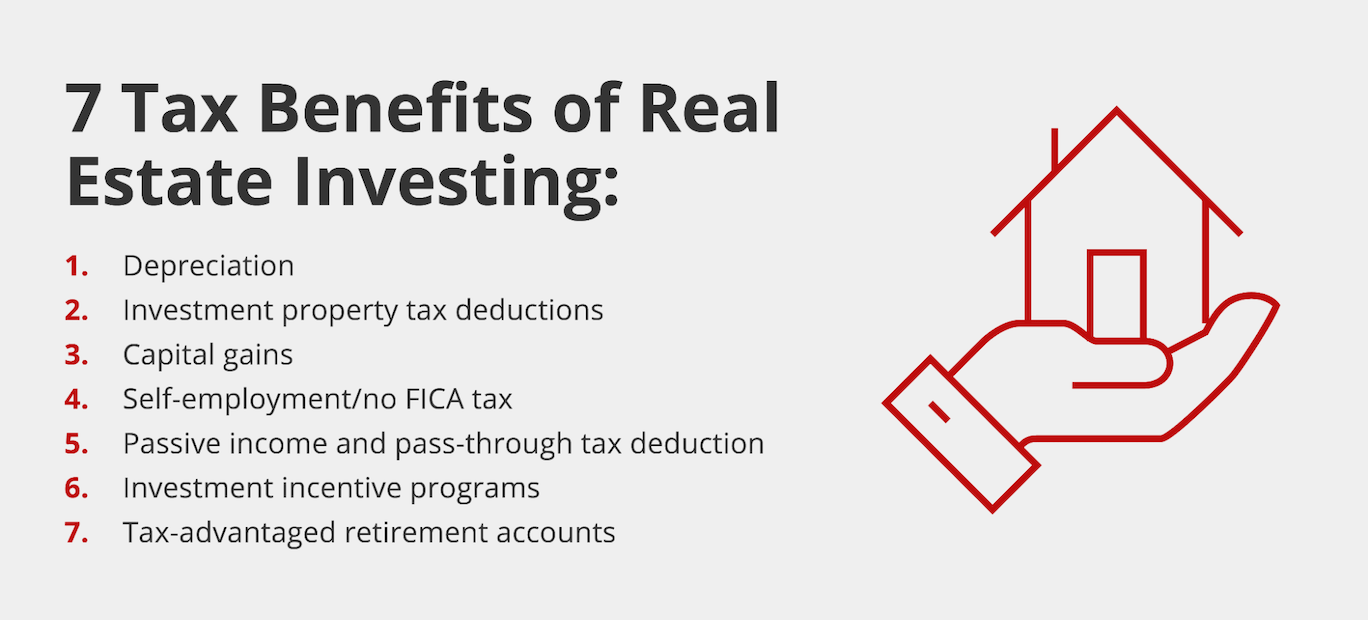

The advantages of buying property are countless. With well-chosen possessions, investors can take pleasure in foreseeable cash money flow, outstanding returns, tax advantages, and diversificationand it's possible to leverage genuine estate to develop riches. Considering purchasing real estate? Here's what you need to understand about realty benefits and why property is taken into consideration an excellent investment.The advantages of investing in genuine estate consist of passive revenue, secure cash flow, tax obligation advantages, diversity, and take advantage of. Real estate investment depends on (REITs) provide a method to invest in real estate without having to own, operate, or money residential properties.

In most cases, capital only reinforces gradually as you pay down your mortgageand develop your equity. Investor can make use of numerous tax breaks and reductions that can conserve money at tax time. Generally, you can subtract the practical expenses of owning, operating, and handling a residential property.

Get This Report about Property By Helander Llc

Actual estate values often tend to raise over time, and with an excellent financial investment, you can transform a revenue when it's time to offer. As you pay down a home mortgage, you develop equityan property that's component of your web worth. And as you build equity, you have the leverage to purchase more residential or commercial properties and boost money flow and wealth also extra.

Since realty is a substantial asset and one that can act as security, financing is easily offered. Real estate returns vary, relying on factors such as place, asset class, and management. Still, a number that several financiers go for is to beat the typical returns of the S&P 500what many individuals describe when they state, "the marketplace." The inflation hedging capability of genuine estate originates from the favorable relationship between GDP growth and the need genuine estate.

The Only Guide to Property By Helander Llc

This, in turn, converts right into greater resources worths. As a result, realty tends to preserve the acquiring power of funding by passing a few of the inflationary pressure on occupants and by including some of the inflationary stress in the kind of funding gratitude. Home mortgage borrowing discrimination is unlawful. If you believe you've been discriminated against based upon race, faith, sex, marriage status, use of public aid, nationwide origin, impairment, or age, there are steps you can take.

Indirect genuine estate investing includes no direct ownership of a residential property or homes. Instead, you buy a swimming pool together with others, whereby a management firm owns and operates residential properties, or else has click here now a profile of home loans. There are several manner ins which possessing property can shield against inflation. Residential property values might rise higher than the price of inflation, leading to resources gains.

Finally, properties funded with a fixed-rate finance will certainly see the family member quantity of the regular monthly mortgage payments fall over time-- as an example $1,000 a month as a fixed settlement will certainly come to be less difficult as rising cost of living deteriorates the buying power of that $1,000. Usually, a primary residence is ruled out to be a genuine estate financial investment because it is utilized as one's home

More About Property By Helander Llc

Despite the assistance of a broker, it can take a couple of weeks of work simply to discover the best counterparty. Still, realty is an unique property course that's simple to recognize and can improve the risk-and-return account of a capitalist's portfolio. By itself, realty uses cash money circulation, tax breaks, equity building, competitive risk-adjusted returns, and a hedge against rising cost of living.

Spending in realty can be an exceptionally fulfilling and financially rewarding venture, yet if you're like a great deal of new investors, you may be questioning WHY you must be investing in actual estate and what benefits it brings over various other investment opportunities. In enhancement to all the amazing benefits that come along with spending in actual estate, there are some drawbacks you require to consider.

A Biased View of Property By Helander Llc

If you're searching for a means to buy right into the property market without having to spend hundreds of countless bucks, inspect out our homes. At BuyProperly, we make use of a fractional possession version that allows financiers to begin with as low as $2500. An additional significant benefit of real estate investing is the capability to make a high return from acquiring, refurbishing, and reselling (a.k.a.

Facts About Property By Helander Llc Revealed

If you are billing $2,000 rental fee per month and you sustained $1,500 in tax-deductible costs per month, you will only be paying tax on that $500 earnings per month (realtor sandpoint idaho). That's a large distinction from paying taxes on $2,000 per month. The profit that you make on your rental device for the year is considered rental earnings and will be exhausted as necessary

Report this page